Why Pre-Qualify When You Can Get Pre-Approved?

Get Pre-Approved in 24 Hours with 90% Approval Rate

Our Simple 3-Step Pre-Approval Process

Licensed in California, Georgia, Texas, and Florida

At Spot On Lending, we skip the pre-qualification and go straight to pre-approval, giving you a competitive edge in today's housing market. Our pre-approval carries more weight with sellers and can be completed in as little as 24 hours.

Ready to Take Your Home Purchase to the Next Level? Our pre-approval process ensures you're fully prepared to make competitive offers. Don't settle for less when pursuing your dream home. Get pre-approved upfront and gain a significant advantage in today's competitive market.

Why Choose Spot On Lending

Our proven process helped close 83% of purchase business for mortgage companies using similar systems. With our secure online application that takes just 12 minutes to complete, you'll be on your way to homeownership faster than you thought possible.

Speed: Get pre-approved in as little as 24 hours

Experience: We've funded over $150 million in loans

Success Rate: 90% of our applications are approved

Client Satisfaction: 97% satisfaction rate

Fast Closings: Average closing time of just 21 days

Are you considering purchasing a new home? Most lenders offer pre-qualification, but at Spot On Lending, we take it a step further with our comprehensive pre-approval process.

While pre-qualification only provides a rough estimate based on self-reported information, our pre-approval:

• Involves thorough verification of your financial documents

• Includes a detailed credit analysis and full automated underwriting

• Results in a stronger offer when shopping for homes

• Can be completed in as little as 24 hours

• Gives you a significant competitive advantage in today's market

Skip the pre-qualification step and get fully pre-approved right from the start!

What's the difference between pre-qualification and pre-approval?

Pre-qualification is a quick estimate based on self-reported information without verification. Pre-approval, which we specialize in at Spot On Lending, involves a thorough review of your financial documents and credit history. This makes our pre-approval letters much stronger when making offers on homes, giving you a significant competitive advantage in today's market.

How long does the pre-approval process take?

At Spot On Lending, we can complete most pre-approvals within 24 hours of receiving your application and supporting documents. Our streamlined process and experienced team have helped us achieve our average 21-day closing time, significantly faster than the industry average.

What documents do I need for pre-approval?

For a complete pre-approval, you'll typically need:

• Last 2 years of W-2s or tax returns (if self-employed)

• Last 30 days of pay stubs

• Last 2-3 months of bank statements

• Valid photo ID

• Proof of any additional income sources

How long is my pre-approval valid?

Our pre-approval letters are typically valid for 90 days. If your financial situation remains the same but you need an extension, we can often update your pre-approval with minimal additional documentation.

Can I get pre-approved with less-than-perfect credit?

Yes! With our diverse loan programs including Conventional, FHA, VA, USDA, and Jumbo loans, we're able to help borrowers across a wide range of credit profiles. Our 90% approval rate demonstrates our commitment to finding solutions for nearly every situation.

Does getting pre-approved affect my credit score?

Good News! We can run a full pre-approval on a soft pull credit report. However, getting pre-approved requires a hard credit inquiry, and must be done at the point of full loan submission, which may temporarily lower your score by a few points. However, multiple mortgage inquiries within a 14-45 day period typically count as just one inquiry for credit scoring purposes.

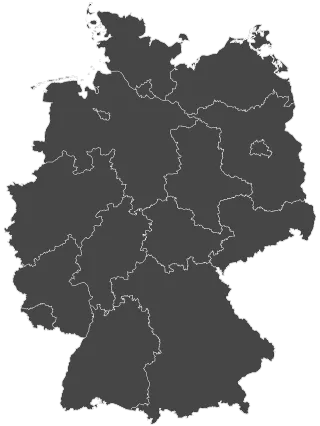

Which states do you offer pre-approvals in?

Spot On Lending is licensed to provide mortgage pre-approvals in California, Georgia, Texas, and Florida. We have physical offices in Laguna Beach, CA, and Marietta, GA, but can serve clients throughout all four states.

What loan types can I get pre-approved for?

We offer pre-approvals for all our loan programs, including Conventional, FHA, VA, USDA, HomePath, Jumbo, Investment, and Commercial loans. We'll help determine which program best fits your specific needs during the pre-approval process.

SELECT LOAN TYPE

Ask Us How You Can Get 1 Day Loan Approval!

Close As Little As 12 Days

Ask about Appraisal Waiver

No Appraisal If Under $150,000

Up To 90% of Home value

Ask If The All In One Loan is right for you

Reverse HELOC Available

Purchase or Refinance with your reverse mortgage

Beneficiaries can keep home

Affordable:

Manufactured homes offer an affordable housing option without compromising on quality. Save money without sacrificing comfort.

Our Team of Experienced Professionals

We're here to guide you through the loan selection process. We'll help you understand the different loan types, their features, and benefits, allowing you to make an informed decision.

About Us

Established in 2018. We have been helping customers afford the home of their dreams for many years and we love what we do.

Spot On Lending is an Equal Housing Opportunity Lender and complies with applicable laws and regulations.

Licensed and Serving Across 4 States:

California NMLS# 02066654 | 60DBO-154093 | Georgia & Texas NMLS#1767407 | Florida NMLS#MBR5826

Serving Across 4 States & Especially These Metro Areas:

California (Orange County, Laguna Beach)

Texas (Dallas Metro Area).

Florida (Tampa Bay Area)

Georgia (Atlanta Metro Area).

Contact Us

Main Office:

California Office:

Disclaimers

Resources

Spot On Lending (“Inc.”), is an Equal Housing Opportunity Lender.

By submitting your information above you agree to be contacted by our team via phone, SMS, or email. SMS message and data rates may apply. Message frequency varies. Reply to any message received with HELP for help or STOP to opt out. For help call us toll free: 1-844-545-1665..